Steps of the Accounting Process

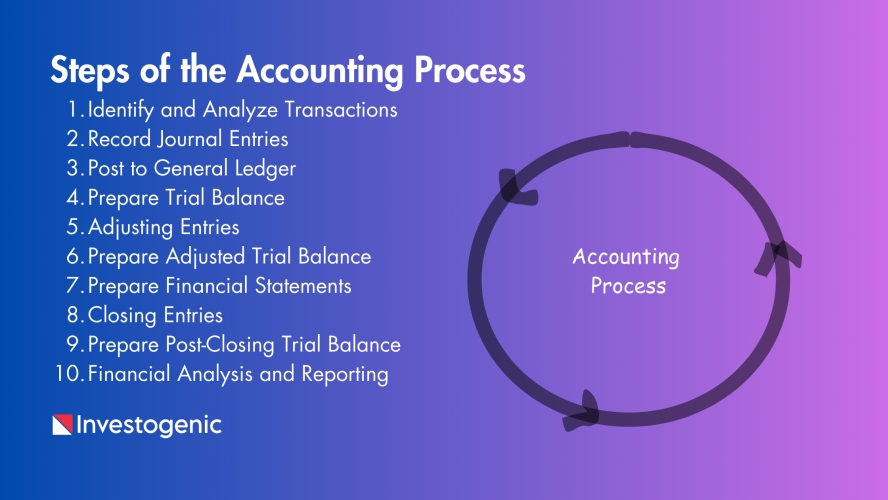

The accounting process involves a series of steps that businesses follow in order to accurately record, summarize, and report their financial transactions. The accounting process is a continuous cycle that is repeated for each accounting period (e.g., month, quarter, or year). It ensures accurate financial reporting, compliance with accounting standards, and effective decision-making based on reliable financial information. This process is designed to make the financial accounting of business activities easier for business owners.

Knowing the phases of the accounting cycle is important for all types of accountants. In the world of information technology, many steps in the accounting process are often automated through accounting software and technology programs. However, small business accountants working on the books with minimal technical support may find it necessary to manually learn and use the steps to better understand the logic behind their actions.

What is the accounting process?

The accounting process refers to the series of steps and activities that an organization or individual follows to record, analyze, and communicate financial transactions and information. It involves maintaining accurate and up-to-date records of financial activities, which are essential for making informed business decisions, ensuring regulatory compliance, and producing financial statements.

These steps help ensure that financial information is organized, accurate, and useful for decision-making. Here are the key steps of the accounting process:

Key Steps of the Accounting Process

Identify and Analyze Transactions:

- The accounting process begins with identifying and analyzing business transactions. Transactions include any financial event that affects the company’s assets, liabilities, equity, income, or expenses.

- Businesses will have many transactions throughout the accounting cycle. Each one needs to be properly recorded on the business’s books.

- Analyzing transactions involves determining the accounts affected and the monetary amounts involved.

Record Journal Entries:

- The next step of the accounting process is to record journal entries in the books of accounts from transactions identified in the first step.

- Journal entries are used to record the details of each transaction in chronological order. Each entry includes the date, accounts affected, and corresponding amounts (debit and credit).

- Debits and credits ensure that the accounting equation (Assets = Liabilities + Equity) remains in balance.

Post to General Ledger:

- The information is transferred to the general ledger after recording journal entries. The general ledger is a collection of all accounts and their balances.

- Debits and credits from journal entries are posted to the appropriate accounts in the ledger.

- This allows a bookkeeper to monitor financial positions and statuses by account.

Prepare Trial Balance:

- A trial balance is a list of all account balances from the general ledger. It serves as a preliminary check to ensure that debits equal credits.

- If the trial balance doesn’t balance, errors in recording or posting must be identified and corrected.

- Once the accounting period has concluded and all transactions have been identified, recorded, and posted to the ledger (typically done electronically and automatically, but not always), this is the first thing that happens.

Adjusting Entries:

- Adjusting entries are made at the end of an accounting period to ensure that the financial statements accurately reflect the company’s financial position and performance.

- Common adjusting entries include recording accrued expenses, prepaid expenses, unearned revenue, and depreciation.

Prepare Adjusted Trial Balance:

- After making adjusting entries, an adjusted trial balance is prepared. This trial balance includes the adjusted balances of all accounts.

- It’s used to verify that all adjustments were recorded correctly and to prepare the financial statements.

Prepare Financial Statements:

- Using the adjusted trial balance, businesses create financial statements: the income statement, balance sheet, and statement of cash flows.

- The income statement shows revenues, expenses, and net income or loss.

- The balance sheet shows assets, liabilities, and equity as of a specific date.

- The statement of cash flows shows cash inflows and outflows during a period.

Closing Entries:

- Closing entries are made at the end of an accounting period to transfer temporary account balances (revenues and expenses) to the retained earnings account.

- The result is a zero balance in revenue and expense accounts, preparing them for the next accounting period.

Prepare Post-Closing Trial Balance:

- This is optional; the business should prepare a post-closing trial balance. After the closing entries have been made, a post-closing trial balance is prepared to ensure that all temporary accounts have been properly closed and the accounts are ready for the next term.

Financial Analysis and Reporting:

- Businesses analyze the financial statements to assess their financial performance, liquidity, profitability, and overall financial health.

- Financial statements are shared with stakeholders, including investors, creditors, regulators, and management.

Learn more: How to Buy Stocks for Beginners: 7 Easy Steps