What Are Unearned Revenues and How Are They Recorded and Reported?

Unearned revenue, also known as deferred revenue or prepaid revenue, refers to payments that a company receives from customers for goods or services that have not yet been provided. Essentially, it represents an obligation on the company’s part to deliver the product or service in the future. It can be thought of as a “prepayment” for goods or services that a person or company is expected to supply to the purchaser at a later date. Unearned revenue is recorded as a liability on the company’s balance sheet until the revenue is recognized and the obligation is fulfilled.

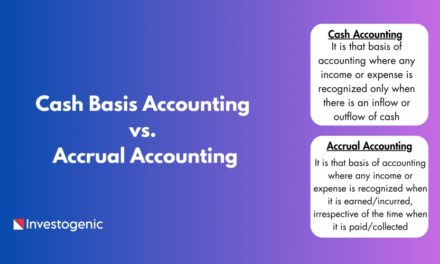

Unearned revenue is an important concept in accrual accounting as it ensures that revenue is recognized in the appropriate accounting periods, matching the revenue with the corresponding expenses incurred to generate that revenue.

Understanding Unearned Revenue

As we discussed above, unearned revenue refers to payments that a company receives from customers for goods or services that have not yet been provided. That type of revenue is most common among companies selling subscription-based products or other services that require prepayments. Mobile or telephone prepaid plans and OTT-based subscription plans are the best examples of unearned revenue for the company because telephone companies have yet to provide services to customers. Other examples of unearned revenue include rent received in advance, prepaid insurance received, clubs receiving prepayment of annual membership, etc.

How Unearned Revenue Is Recorded and Reported

Initial Receipt of Payment

When a company receives payment from a customer for goods or services that will be provided in the future, it records the payment as unearned revenue. At this point, no revenue is recognized on the income statement because the company has not yet fulfilled its obligations.

Recognition of Revenue

As the company fulfills its obligations and delivers the goods or services, it gradually recognizes the unearned revenue as earned revenue. This recognition is typically done in proportion to the completion of the work. As each portion of the obligation is met, the corresponding amount of unearned revenue is moved from the liability account to the revenue account on the income statement.

Journal Entries

The process of recording unearned revenue involves journal entries in the company’s accounting records.

- At Receipt of Payment: The initial entry to record the receipt of payment is:

- Debit: Cash or Accounts Receivable (depending on how the payment was received)

- Credit: Unearned Revenue (liability account)

- As Revenue Is Recognized: When the company fulfills its obligations and recognizes the revenue, the entry is:

- Debit: Unearned Revenue

- Credit: Revenue (e.g., Service Revenue, Product Sales)

Financial Reporting

Unearned revenue is reported on the company’s balance sheet as a liability. It falls under the “Liabilities” section and is categorized as a current liability if the revenue is expected to be recognized within one year. If the recognition period extends beyond a year, it would be categorized as a long-term liability.

As the unearned revenue is gradually recognized as earned revenue, it flows through the income statement as revenue. This recognizes the revenue in the appropriate period when the goods or services are provided.

Example

Let’s say a company receives $1,800 in advance for a one-year subscription on 1st January 20XX to its software service. At the time of payment, the journal entry would be:

| Date | Particulars | LF | Debit (Amount) | Credit (Amount) |

|---|---|---|---|---|

| 20XX 01-01 | Cash A/c (or Accounts Receivable) Dr To Unearned Revenue A/c (Being the amount received as an advance for a one-year subscription) | $1,800 | $1,800 |

As each month passes and the service is provided, the company recognizes $150 as revenue and reduces the unearned revenue liability by that amount:

| Date | Particulars | LF | Debit (Amount) | Credit (Amount) |

|---|---|---|---|---|

| 20XX 01-31 | Unearned Revenue A/c Dr To Service Revenue A/c (Being revenue recognized for the month of January) | $150 | $150 |

This process continues until the entire $1,800 is recognized as revenue and the unearned revenue liability is reduced to zero.