Double-Entry Bookkeeping: What It Means in Accounting and How It’s Used

Double-entry bookkeeping is a fundamental accounting method used by businesses to track their financial transactions. It ensures the accurate and balanced recording of financial transactions. It involves systematically tracking the inflow and outflow of financial resources in a business or organization. This method provides accuracy and transparency, helps in balancing accounts, and is helpful in preparing a complete balance sheet, income statement, and cash flow statement.

A double-entry accounting system ensures accurate financial reporting, reduces the chances of errors and fraud, and provides a comprehensive view of a business’s financial health. It’s a cornerstone of modern accounting and is used by businesses of all sizes to maintain proper financial records and meet reporting requirements.

What Is the Double Entry Accounting System?

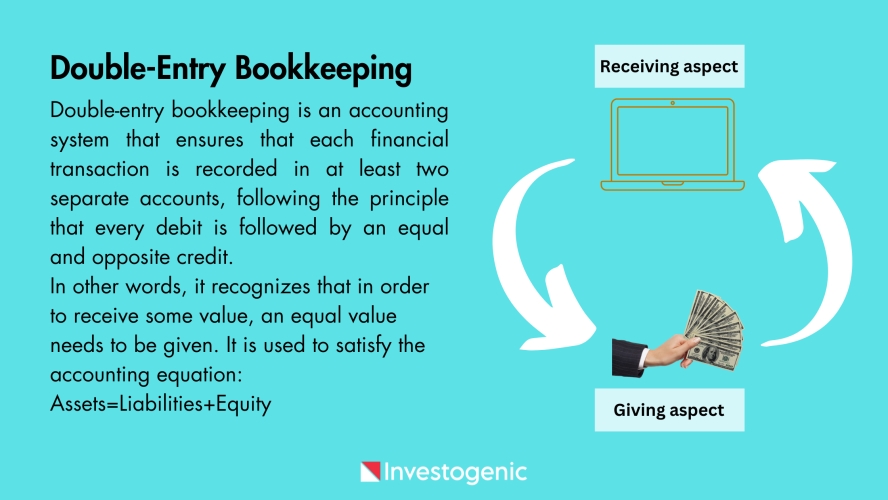

Double-entry bookkeeping is an accounting system that ensures that each financial transaction is recorded in at least two separate accounts, following the principle that every debit is followed by an equal and opposite credit. In other words, it recognizes that in order to receive some value, an equal value needs to be given. It is used to satisfy the accounting equation: Assets=Liabilities+Equity

Understanding Double Entry Accounting System

Let us understand this with an example. Say you buy a computer by paying $2,000 in cash.

Now if you look closely at this transaction, there are two parts to it: You are receiving a computer, which can be called the receiving aspect. Second, you are paying cash, which can be called the giving aspect.

Now when we apply the double-entry bookkeeping aspect to this transaction, we get

- Both aspects will need to be recorded, i.e., the receiving aspect (computer) and the paying aspect (cash).

- According to the double entry system, at least two accounts will be affected by each transaction. In the above example, the computer is one account, and cash is the other account.

So, when books are maintained using a double-entry accounting system, every transaction involves a debit entry in one account and a credit entry in another account (these debit and credit rules depend on the nature of the accounts). This is because you have an account that receives the value and another account that has given the value.

When you look at the above example, the computer account will be debited since it has received the value (inward), and the cash account will be credited because it has given the value (outward).

To summarize, under the double-entry accounting system, in every transaction, one account is debited and another account is credited.

How the Double-Entry Bookkeeping System Works

- Types of Accounts: In a double-entry bookkeeping system, accounts represent different aspects of a business’s financial activity. It means that the transactions or activities of a business are classified under different accounts for recording purposes. These standard accounts include the following:

- Assets (cash, inventory),

- Liabilities (loans, payable amounts),

- Equity (owner’s investment),

- Revenue (sales),

- Expenses (salaries, utilities).

- Gain,

- Losses

- Debits and Credits: At least two accounts are involved in every transaction. Debits and credits are used to record increases and decreases in account balances. The basic rule is debit on the left and credit on the right. This debit and credit rule works on each type of account, and each type of account is personal, real, or nominal.

- Assets and Expenses: Debit increases, credit decreases.

- Liabilities, Equity, and Revenue: Credit increases and debt decreases.

- The Accounting Equation: The basis of double-entry bookkeeping is the accounting equation: assets = liabilities + equity. It is the foundation of the double-entry accounting system. This equation ensures that every financial transaction affects at least two accounts to balance the equation. The balance sheet is based on the double-entry accounting system, where the total assets of a company are equal to the total liabilities and shareholder equity.

- Recording Transactions: Each transaction is recorded in a journal, where debits and credits are noted for each account involved. Then, these entries are transferred to ledgers, which are organized accounts that provide a snapshot of a business’s financial position.

- Trial Balance: At regular intervals (often monthly or annually), a trial balance is prepared. It lists all accounts with their debit and credit balances. If the debits and credits are equal, the trial balance is considered balanced.

- Financial Statements: From the trial balance, financial statements like the income statement (profit and loss statement) and balance sheet can be generated. These statements provide insights into a business’s financial performance and position.

- Error Detection: The double-entry system helps in error detection. If the trial balance doesn’t balance, it indicates an error in recording transactions that need to be identified and corrected.

Example of a Double-Entry Bookkeeping System

Double-entry system accounting ensures that each financial transaction is recorded in at least two separate accounts. These accounts should maintain an equal balance at all times. Here are some examples of double-entry bookkeeping systems:

Example 1: If a company has made sales revenue of $1,000 on January 1st, 20XX, then, as per the double-entry system, it will need to make two entries when recording the data:

| Date | Particulars | Debit (Amount) | Credit (Amount) |

|---|---|---|---|

| 20XX Jan. 01 | Cash/Bank A/c Dr To Sales A/c | $1,000 | $1,000 |

Example 2: A company took a $10,000 loan on January 2, 20XX, from their bank to be repaid within 12 months. As per the double entry system, it will need to increase both its cash and liability accounts by this amount.

| Date | Particulars | Debit (Amount) | Credit (Amount) |

|---|---|---|---|

| 20XX Jan. 02 | Cash/Bank A/c Dr To Loan from bank A/c | $10,000 | $1,000 |

Benefits of a Double-Entry Accounting System

- It records both sides of the transaction.

- Separate accounts for purchases and payments are maintained.

- This helps in cross-checking accounting documents.

- It assures arithmetical accuracy of the books of accounts, for every debit, there is a corresponding and equal credit.

- This is a scientific method.

- This makes it easy to identify fraudulent transactions.

- Errors can be checked and rectified easily.

- Profit and loss can be calculated easily.

Learn more: Steps of the Accounting Process